Residential Care

Benefits

Empowered

Accelerate lifestyle activities by reducing administrative workload

Independent

Staff not involved in residential personal financial management

Ease

No resident cash held at facility and no re-billing for third party invoices

Reduce Risk

Eliminate or dramatically reduce risks associated with cash management

Pay Fast

We pay service providers quickly to help ensure services are received

Step 2

Resident or family member signs up by form or online

Deposit Details

National Australia Bank

Note, every account has their own bsb and account number, available on login, preferable this is used, as below is dependent on Reference accuracy.

Capital Guardians

BSB: 083-817

Account number: 976768492

Reference / Description: Initials and Surname(up to 18 character)

Westpac New Zealand

Capital Guardians

Bank & Branch: 031509

Account: 0079780

Suffix: 00

Code / Reference: First name, Surname and facility are to be shown in the “Reference” fields

NDIS Provider Payments – Single Click Approvals

NDIS Provider Payments – Single Click Approvals When it comes to NDIS provider payments (and care payments in general) we’re constantly striving to increase payment governance while continuing our mission to simply, if not totally eliminate administration burdens from all involved in care. NDIS payment problems and delays can arise for many reasons – non-approval …

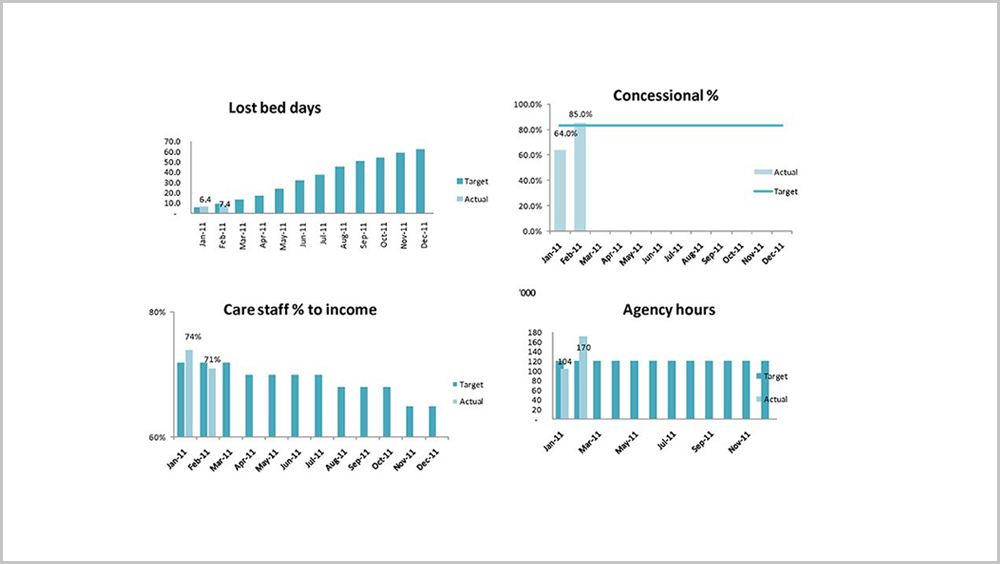

Best Practice Aged Care Management Reporting

Best practice in business requires focus on the right measures, to help drive the right behaviours in optimising long term performance and risk management. It is also about getting the balance right, allowing managers to manage, and get report only on what matters. Otherwise, eliminate administrative burdens. Driving performance requires a focus on few key indicators, …

Residential Consumer Directed Care: The People Pleasing Industry is already here

Home care is already 100% consumer directed care (CDC), with funding and choice sitting with individuals with home care packages. Both the Department of Human Services and industry associations inform us that Residential CDC is now being planned. As a result a ‘Road Map’ has been developed and research funded to inform us of what …

Residential Consumer Directed Care: The People Pleasing Industry is already here Read More »

The death of cash payments in aged care facilities

In the wake of Covid-19, many retailers are encouraging consumers to use contactless payments rather than physical cash. Even prior to Covid-19, cash was on the way out in aged care and the health industry, due to the: direct costs of managing cash, in bank costs and administration indirect costs of staff time in managing …

The death of cash payments in aged care facilities Read More »